Sell or Buy a business

Transparent stages to ensure everyone is on the same page.

You’re 4 stages away from selling your business. With a trusted UK business broker, selling your business knowing your employees will be in good hands is what we’re good at.

Planning and Preparation

Ideal exit plan, Evaluations and everything in between. This stage is to ensure you’ve thought of everything and if selling your business is the right decision for you.

Marketing

The Harris Acquire team will create a fantastic marketing pack to promote your business and showcase the current value and potential. This will be sent to competitors and investors to receive offers.

Negotiation

Once we’ve identified key investors and received offers, we will sit down with you and the team to review and discuss negotiations to achieve the best price and exit terms.

Due Diligence

Once Heads of Terms have been signed, we move onto Due Diligence which is a step for business acquirers to check that operationally and financially the business is correct.

Closing

Getting the deal over the line and commencing with the exit strategy.

Group trusted by some fantastic companies;

Our marketing campaigns have supported the above companies and many more.

Testimonials

M&A

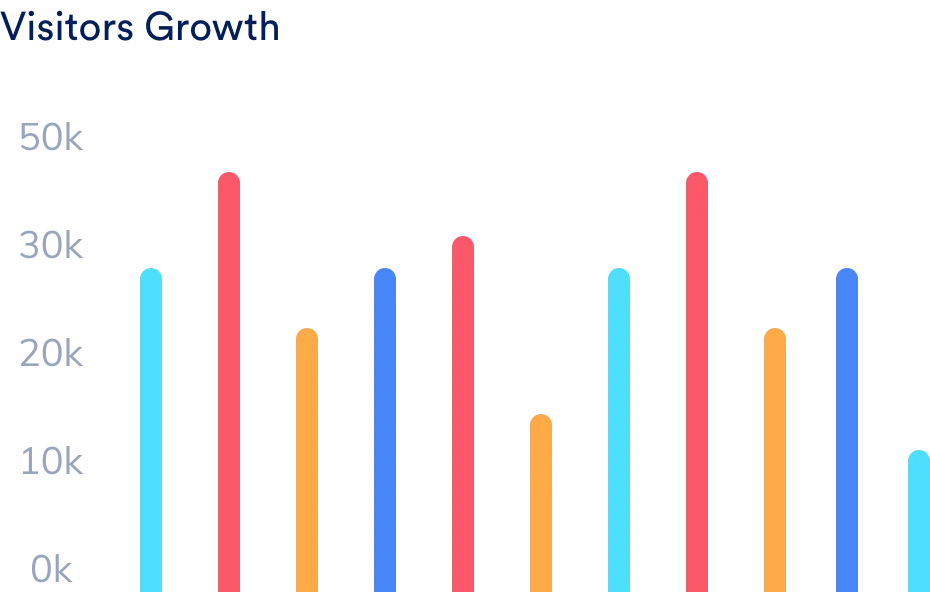

Analyse your business to find out how much it's worth.

Understanding how valuable your business is can holt or speed up your decision to sell your business. Our specialist business advisors will be able to assist with your decision making journey to see if it’s a viable route to take based on your life goals and aspirations.

Browse the other businesses we're currently helping

Not limited to the UK, we are business brokers who can help businesses on a global scale to sell, acquire and merge businesses. From 1million to 250million turnover businesses, we can help.

Got questions?

Well, we've got

answers

For most businesses, it’s rare for acquisitions to occur frequently, and it’s not normally likely that you or your team will have the latest knowledge necessary to navigate a deal. Our services offer professional guidance as needed to ensure that you secure the optimal deal.

By leveraging our expertise as business brokers, you can augment your business’s value during a sale, minimise costs, avoid acquisition-related pitfalls, and reduce the expenses associated with financing.

By using our business acquisition expertise, we can hand pick suitable businesses that fit your acquisition criteria to ensure you’re investing in the right businesses to match your goals. Alongside avoiding common pitfalls that can occur during business mergers and acquisitions.

Our company is distinct because we adhere to our core value of “doing the right thing,” which is ingrained in our culture. In an industry that has made mistakes in the past, Harris Acquire Mergers & Acquisitions strives to do things correctly. Our approach prioritises our clients’ interests over our own, and we firmly believe that there are no boundaries to doing what’s right. This is the guiding principle that underpins our business operations.

Although we may facilitate introductions between parties, we are not simply a business broker; we are professional advisors. Our value proposition goes far beyond a mere introduction service. We assist you in formulating and communicating your business case, negotiating terms, and overseeing the deal’s completion, all of which significantly enhance the final outcome and add substantial value to your transaction.

The bulk of our fees are “Success Fees,” which indicates that we are paid upon the deal’s completion. We are meticulous in ensuring that our fees align with your objectives. We take pride in the fact that our fees are always proportionate to the value we provide.

Yes we can. We have numerous contacts across Europe, America and Australia to ensure your deal runs smoothly when you are buying or selling a business overseas.

Our owner (Metric Central) and sister companies are all based in Warwick, UK. Here’s our address: Pure Offices, Wilton Drive, Warwick, CV34 6RG. Our Head Office number is: (+44) 01926 757100

Could you retire now?

How much is your business worth?

Talk to a member of our business acquisition and merger team to evaluate your business for free. No hidden costs.